Top Penny Stocks On Robinhood 2021

The markets took a pounding last week, with many stocks going lower. But for penny stocks on Robinhood 2021, or penny stocks in general, it was a different story entirely. If you are indeed new to the world of low-priced stocks, you will already be aware of this trend. This trend was also prevalent in the Nasdaq and Dow, both taking it on the chin.

However, there were plenty of penny stocks that surged higher. Some of the biggest gainers were lower-priced stocks that started trading for under $5.

So, the question is, what should you be watching in the weeks ahead? If you are looking for industry trends, you would like to follow. The biotech sector might be something you could focus on. 2 stocks demonstrating results include S&P Biotech ETF (NYSE: XBI) and NASDAQ Biotech ETF (NASDAQ: IBB). Both were trading higher during the Monday pre-market session.

Sector strength attracts traders to find potential. But not all penny stocks within the industry will follow the trend. However, it is more than likely that a few will. We will look at some of the former biotech stocks to watch in this article.

Robinhood Penny Stocks You Need To Watch

Supported by the growing trend and interest from retail traders, apps like Webull and Robinhood have become increasingly popular. A downside of the apps experienced by several traders is that access to almost all of the OTC penny stocks is restricted. Still, there are a few exceptions to this. On the apps, your choices can be limited to NYSE and Nasdaq listed companies. So, this will be the main focus today to discover penny stocks on Robinhood 2021.

Buying Penny Stocks On Robinhood

Indeed, you can buy some penny stocks on Robinhood, but your choices might be limited. It often depends on the stocks you’re after.

If you are after stock listed on the NYSE or Nasdaq that are under $5, then you will have no problem accessing these stocks on Robinhood.

However, if you are looking for OTC penny stocks or pink sheets, you might be out of luck because Robinhood will not let you trade them on the platform. So, we will focus on penny stocks listed on the NYSE and Nasdaq for penny stocks on Robinhood 2021 that you can buy.

- Xinyuan Real Estate Co., Ltd. (NYSE: XIN)

- GT Biopharma Inc. (NASDAQ: GTBP)

- Iconix Brand Group, Inc. (NASDAQ: ICON)

- Anavex Life Sciences Corp. (NASDAQ: AVXL)

- Clearside Biomedical, Inc. (NASDAQ: CLSD)

- Opko Health Inc. (NASDAQ: OPK)

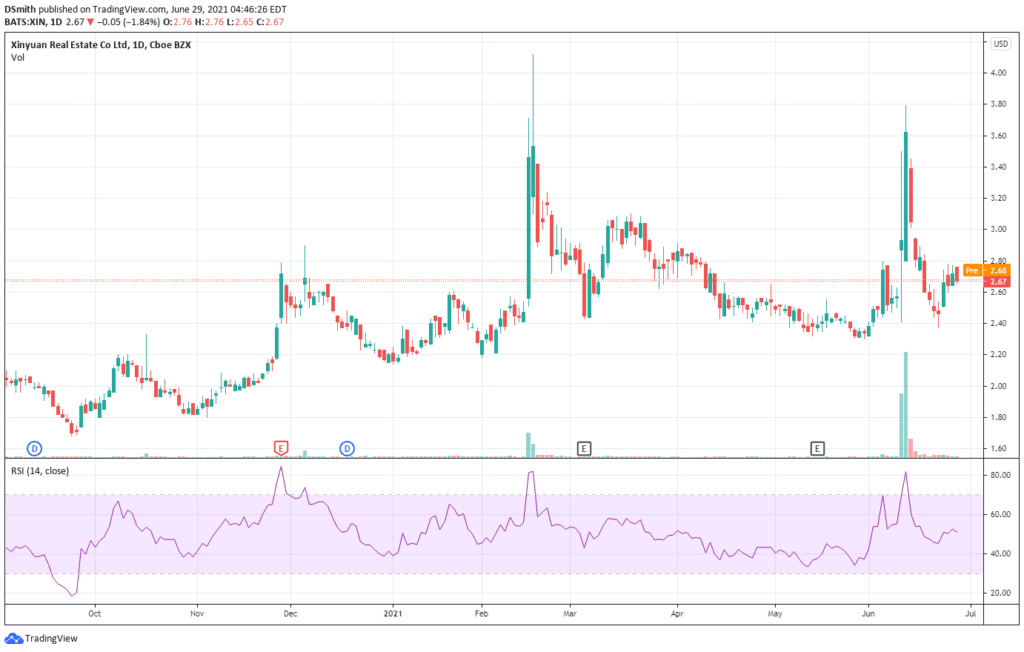

Xinyuan Real Estate Co., Ltd. (NYSE: XIN)

The NYSE listed real estate developer and property management firm, developing large-scale, high-quality real estate projects throughout China. Xinyuan Real Estate was the first Chinese real estate company to enter the U.S markets. Over the last few years, Xinyuan has been active in real estate developments in New York.

The company announced that it had completed five constructed properties in China. The company built the properties to high specifications in central locations in China. Offering tenants convenient transport options, quality lifestyle, which are close to commercial and educational facilities.

Mr. Zhang Yong, the chairman of Xinyuan Real Estate Co., Ltd, commented that the company is thrilled to complete the five high-quality accommodations. The company believes that the project highlights its commitment to completing high-quality constructions to meet the exceeding client demands. The company will continue to deliver comfortable and convenient real estate services and products to middle-class consumers.

Looking at the chart for XIN, you can see a huge volume spike on 11th June. After the spike up to $3.80, prices fell to $2.40. Prices are now at $2.68. Could XIN have more potential upside, and did XIN make it onto your watchlist?

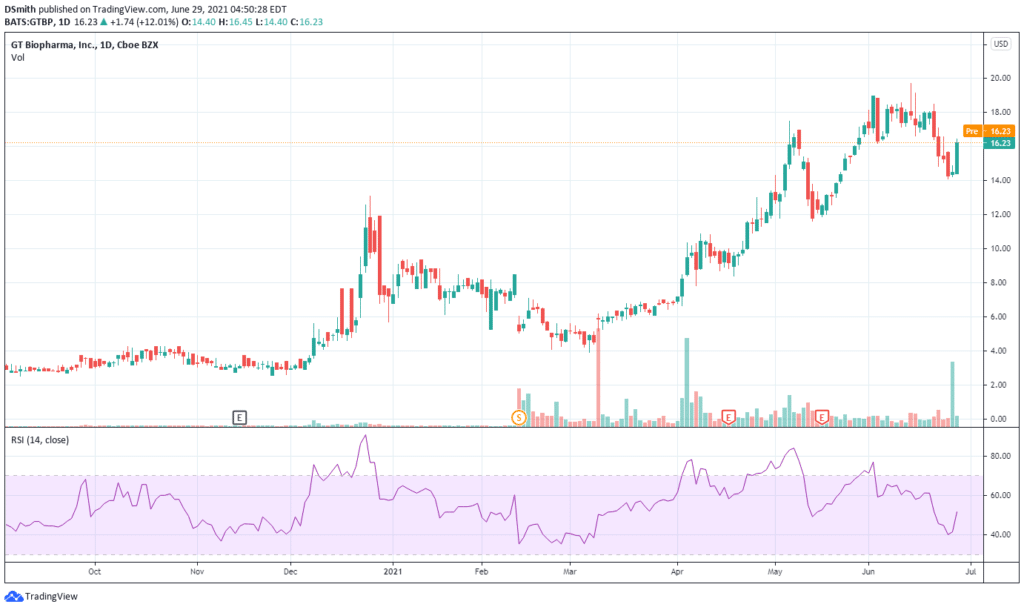

GT Biopharma Inc. (NASDAQ: GTBP)

GT Biopharma Inc has been on our watchlist for some time now, and it springs to our attention again. The leading Biopharmaceutical company with its innovative TriKE platform is designed to combat cancer-killing abilities found in patients.

GT Biopharma announced its GTB-3550 TriKE™ monotherapy clinical trial interim results at the 2021 Raymond James Health Innovation. They reported that 57% of patients showed a significant reduction of AML/MDS cancer cell burden when they received the dose of GTB-3550 TriKE™. The overall results were excellent, reporting that the patients tolerated the doses, and restoration of the patient’s cell functions had also improved.

GT Biopharma is pleased with the results and safety profile of GTB-3550, restoring the function of the patient’s NK cells.

The company has now completed treatment on eleven patients. The test showed strong safety results and a significant reduction in cancer cells. The signs are very encouraging as the company expands efficacy to the current clinical trial of GTB-3550.

Looking at the GTBP chart, you can see the price rising from March to June. There was a recent spike in buying volume on 25th June.

Could there be more upside potential for GTBP, and is this a stock worth more research?

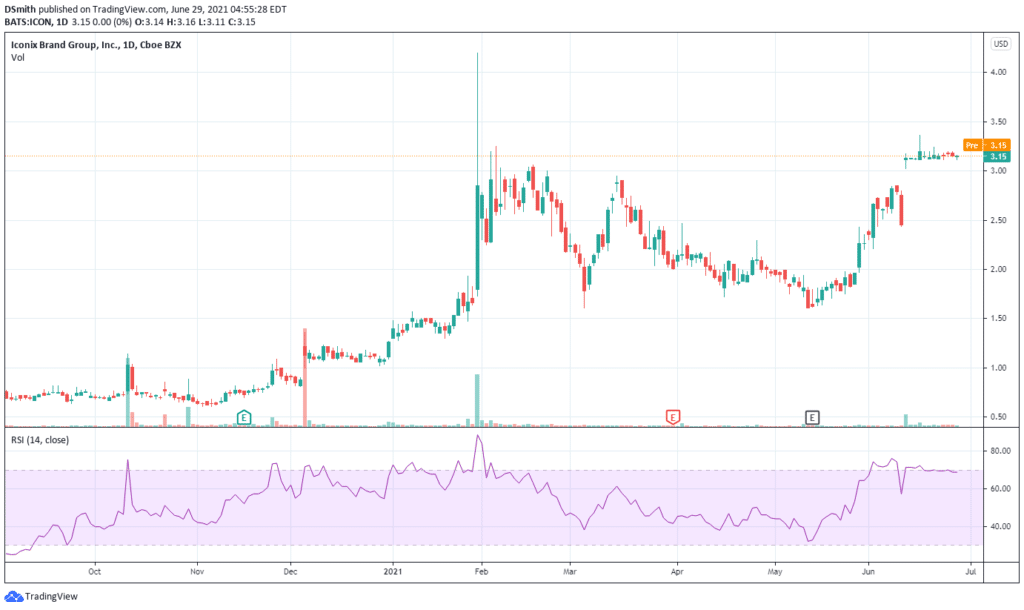

Iconix Brand Group, Inc. (NASDAQ: ICON)

Iconix Brand Group owns licenses and markets a range of consumer brands, including BONGO ®, OCEAN PACIFIC ®, and many more. The company licenses its brands to manufacturers and retailers. The company manages its brands to drive greater consumer awareness and brand loyalty.

Iconix Brand Group reported their 3rd quarter results for 2020. The overall results were to be expected, given the impact of the pandemic. The total revenue was $24.5 million, with a continued improvement on cost structure, decreasing the expenses by $16.4 million.

Iconix Brand Group continues to navigate through the pandemic the well-being of employees and licensees remains its priority. Despite the pandemic, the company has continued expanding the business, with a successful launch of UMBRO products in Walmart.

The company remains focused on building its pipeline of future business, resulting in 148 deals in 2020 for royalties of approximately $90 million.

The ICON chart shows a surge in price on 29th January; after that, prices traded sideways until May. Recently price made a gap up on 11th June, with price now appearing to be in a tight range. Could more buying pressure come in during the current months, and is ICON worth more investigation?

Anavex Life Sciences Corp. (NASDAQ: AVXL)

Anavex Life Sciences is a biopharmaceutical company. They are developing therapeutics to treat Alzheimer’s disease and Parkinson’s disease. The lead drug candidate is ANAVEX®2-73 (blarcamesine), successfully completing a phase 2 clinical trial for Alzheimer’s disease and a phase 2 for Parkinson’s disease.

Anavex Life Sciences announced its phase 2 progress with Parkinson’s disease. It is the first time that a specific drug correlates with clinical efficacy endpoints in Parkinson’s disease.

Because of the positive trial results, a JonesTrading analyst raised Anavex price target to $50 from $35, confirming a buy rating. Furthermore, it traded at $28.75 and increased by 16% throughout the last six months.

Prices have been surging from May to the present on the AVXL chart. The stock is displaying a strong uptrend with several buying gaps throughout June. Prices are now at $28.86 after a gap up on 28th June. The question is, will prices keep rising, and did AVXL make it onto your watchlist?

Clearside Biomedical, Inc. (NASDAQ: CLSD)

Clearside Biomedical has been on our watchlist for some time now, and it comes to our attention yet again. Clearside Biomedical is a biopharmaceutical company developing and delivering treatments for serious eye diseases. The company’s leading product is the SCS Microinjector®, offering unique access to the retina and choroid where sight-threatening diseases often occur.

Clearside Biomedical took off by 38% after the company announced positive results for CLS-AX, therapy for wet age-related macular degeneration. The results showed that the drug was safe and indicated early signs of efficacy.

The company will now move onto cohort 2, and the year-end should complete the study. Overall, the analyst ratings are a buy or strong buy.

After the recent surge in price indicates plenty of upside potential in store for this stock.

Looking at the CLSD chart, you can see a huge buying spike on 15th June, making price leave sizeable gaps to the upside. Prices are now trading at $4.70, and the question is will the price come down and fill these gaps, or will prices continue to rise? Did CLSD make it onto your watchlist, and is this a stock worth watching?

Opko Health Inc. (NASDAQ: OPK)

Opko Health is yet another biopharmaceutical and diagnostics company intending to establish an industry-leading position in rapidly growing markets. The company leverages its developments and discoveries, and novel technologies.

The company entered a deal with Nicoya Macau Limited. For the commercialization and development of RAYALDEE. A Treatment for hyperparathyroidism in stage 3 or 4 of kidney disease.

Opko Health’s main aim is to utilize Nicoya’s expertise and target the growing market in China with unmet clinical needs relating to kidney health. Currently, it is reported that China has approximately 19 million people suffering from these problems.

Currently, the stock has outperformed the industry over the last year, demonstrating an increase of 30.8% compared to the industry at 25.2%. Currently, the Zacks Rank for this stock is a hold.

OPK has been selling off throughout most of this year, with prices dropping from $6.30 to $3.32. Presently prices are either in a correction or perhaps trying to move higher. OPK chart demonstrates steady volume and is neither oversold nor overbought. Could prices start to rise in the coming months, and did OPK make it to your watchlist?

Conclusion

Building a list of penny stocks on Robinhood can be challenging, especially when searching for the best trading setups and stocks demonstrating potential. Quickly, you will build a large list of stocks; this often happens to the best traders as well.

That’s why building a watchlist is essential if your personal selection of symbols are showing potential. Some traders will keep multiple watchlists, putting stocks under sectors or trading chart setups.

Biotech Penny Stocks With Potential

Even during the current market trends, when most sectors have been heavily hit, some stocks have emerged as winners. ETF’s, S&P, and Nasdaq have seen declines over the last few days, but the biotech sector has weathered the sell-offs. With this persistent trend, only time can tell. Overall, with the current evident trend, stocks demonstrating exposure to it could be the ones to watch by the end of the month.