Are The Epicenter Stocks On Your Watchlist?

Indeed, the pandemic did a lot for stocks, and it also brought epicenter stocks to our attention. It also completely changed how people looked at stocks today. But you will always have your small retail traders and people flipping cheap stocks. Last year brought new meaning for penny stocks. These are stocks trading at $5 or under; the global shutdown made some of these penny stocks some of today’s largest companies. Indeed, it also put quite a few out of business completely.

An example of this is Hertz (OTC: HTZZ). Before everything shut down, the stock was happily trading above $20. Still, prices started to sell off during the pandemic and left them trading at $0.40. Hertz was not the only affected company to become a stock trading under $5. Ford Motor’s (NYSE: F) plummeted from $9 to $4. We even witnessed meme stocks falling on hard times like Game stock (NYSE: GME) and AMC Entertainment (NYSE: AMC). There were many more casualties affected by this sweeping dip.

The result of this was heavily invested stocks; Traders ultimately turned to penny stocks or cut their losses immediately. Furthermore, it brought many new traders into the markets who had never traded stocks in their lives. These new traders were armed with extra money and extra time. Ultimately the former industry titans became a focus and have been coined as Epicenter stocks.

So, What Are Epicenter Stocks?

Epicenter stocks were originally bought by the investor Tom Lee, who jumped on this trend early. It planted the flag in all stocks affected by the pandemic. Lee’s theory was simple, the stocks that were hit hardest would bounce back in light of vaccines and economies restarting. If you take a look at many of these Epicenter stocks, the theory was correct, apart from meme stocks. You have Nautilus (NYSE: NLS) and Party City (NYSE: PRTY), the prime example of stocks bouncing back as the economies started to get back on track.

We are almost through another year, with businesses reopening over the past months. Do we have any epicenter stocks to watch right now? The answer is yes, and you could be looking at a hybrid between pre-pandemic like retail and energy to the 2020 trends. Indeed, some of the 2020 trends will fade, but others have been put into the spotlight. All these things considered, what epicenter stocks are you watching right now?

JetBlue (NASDAQ: JBLU)

Marriott (NASDAQ: MAR)

Caribbean Cruises (NYSE: RCL)

Southwest Airlines (NYSE: LUV)

JetBlue (NASDAQ: JBLU)

JetBlue is a leading airline carrier in Boston and several other states offering low fares. Also, it happens to be New York’s hometown airline. The carrier has around 47 international destinations.

Recently JetBlue plans to operate 700 daily flights from New York and Boston as customers return to travel. JetBlue is unlocking more destinations, offering a better suite of products and a premium experience for travelers.

Indeed, the demand for travel is returning, and JetBlue intends to make it easy for travelers coming back to flying. With their partnership with Northeast Alliance, JetBlue has already gained access to 57 new market routes and connections to more than 150 worldwide destinations.

Indeed, JetBlue is a healthy company with a bright outlook. Still, its stock price depends largely on industry forces at play. The demand for flights is still climbing, but there are concerns over variants like Delta that have investors rattled.

Some analysts have a buy rating on JetBlue, with an expected price target of $20. Even with the uncertainty and volatility of the airline industry, JetBlue is seen as a safe pick. The analyst’s rating is mainly due to the company having minimal exposure to disruption in international travel.

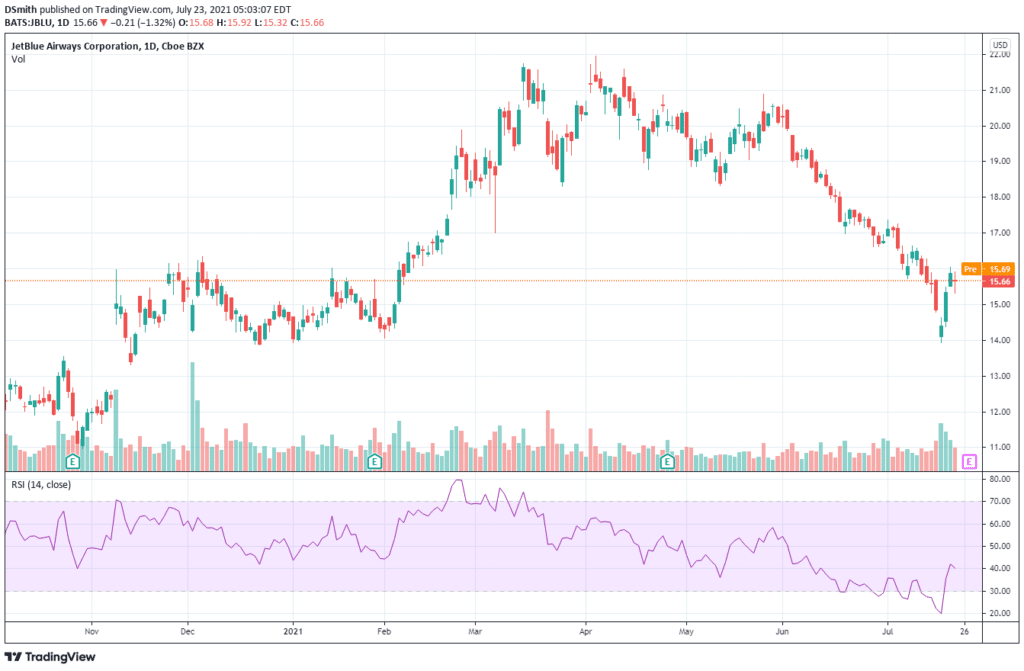

Looking at the JBLU chart, you can see prices being pushed from $21 to $14 from June to July. JBLU has good volume and recently reached the oversold area on the RSI. Prices are now trading at $15.66. Will buyers push the stock back up to new highs, or will sellers push prices lower? Did JBLU make it onto your watchlist?

Marriott (NASDAQ: MAR)

Marriott International franchises operate and license hotels, timeshare properties, residential properties worldwide. Marriott is a global leader with an impressive portfolio worldwide.

Recently Marriott discussed the recovery of the leisure and travel industry. As the industry begins to recover from the pandemic, the demand for leisure and travel is increasing. Marriott believes this return back to pre-pandemic times will be the catalyst for a strong recovery in travel as well.

Indeed, normality seems to be on the horizon for Marriott, reporting an occupancy rate through the roof on the 4th July. The company also witnessed real pricing power and was 10% ahead of 2019. Furthermore, Marriott’s unit growth continues to be strong, with 24,000 rooms opened in the first quarter, and their pipeline is steady at more than half a million rooms.

There are many opinions about the future of business travel right now. But Marriott believes that it will bounce back, even stronger than before. They are witnessing travel and leisure demands rising rapidly. The good news is that some industries have thrived through the pandemic.

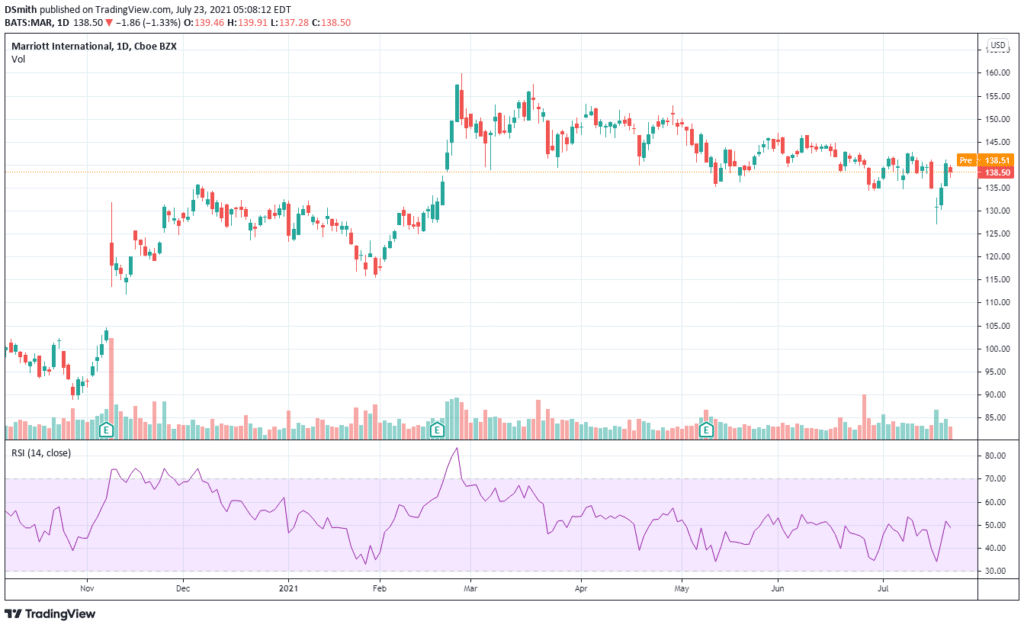

MAR has been trading sideways from March until now. Prices have been trading between $160 and $127. The volume is good, and the price is neither overbought nor oversold. MAR is currently trading at $138.50. Will buyers push the prices higher in the coming months, or will sellers push the stock into decline? Did MAR make it onto your watchlist?

Caribbean Cruises (NYSE: RCL)

Royal Caribbean Group is a global leader operating cruises worldwide. The company Operates under Celebrity cruises, Silversea cruises, Royal Caribbean International, and Azamara brands to over 1,000 global destinations.

Royal Caribbean is an intriguing choice for investors right now due to the security of the leisure and recreation spaces seeing solid earnings estimates. Indeed, a rising tide will lift all boats in the industry, with broad trends throughout the market that are ultimately boosting securities across the board.

Royal Caribbean is looking good right now, with solid earnings estimates over the last few months. Its recent performance suggests that analysts are becoming bullish on its prospects for the short-term and long-term. Overall, Zacks Rank recommends Royal Caribbean as a decent pick in a strong industry. The industry is not only in the top third, it also has solid earnings estimates.

Compared to its peers, Royal Caribbean was one of the least affected companies during the pandemic. The company managed to increase its outstanding shares by 22%, and analysts believe it will return to profitability in 2022.

RCL chart has been selling off since June. Prices reached the oversold reading on the RSI in July. Prices are currently trading at $77.76 with decent volume. Will buyers push prices higher, or will we see a further decline? Is RCL a stock to watch?

Southwest Airlines (NYSE: LUV)

Southwest Airlines Co is a leading passenger airline operator, providing scheduled air transportation in the U.S and near-international markets. The company operates a fleet of 718 Boeing’s 737 aircraft, serving 107 destinations in 40 states.

Domestic leisure travel has nearly recouped from 2019 levels, and airlines say that domestic business travel will fully recover in 2022. International travel is still uncertain due to entry bans. But when restrictions are lifted, there will be an increase in bookings.

Southwest Airlines was profitable in June, even without federal funding. It is the first since the pandemic began in 2020. Additionally, Southwest reported earnings of $4 billion, which beat expectations. Right now, the company’s profits have almost doubled compared to the first quarter, with customer demand looking positive for the year and beyond.

Southwest expects good results on international flights and believes that every destination is different due to variants of Covid presently. But the company’s finances have stabilized, and they feel they are in a strong position to action their plans. Demand is the key, and it is strongly recovering, and the airline continues to run the best service in the country. Overall, Southwest is in great shape, and plan to execute their plans for the future.

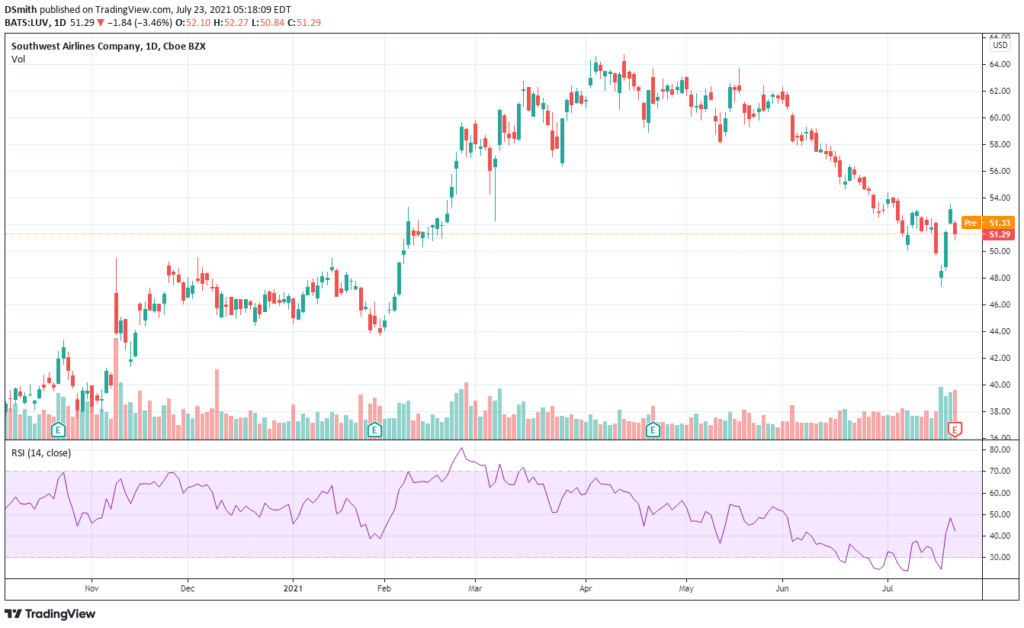

LUV’s prices have been declining from May to the present. Sellers pushed the price from $62 to $48. In July, prices reached the oversold level on the RSI, followed by increased volume, creating a bounce in price. LUV is now trading at $51.29, with earnings released yesterday. Will LUV continue to decline, or will buyers push prices higher in the months ahead. Did LUV make it onto your watchlist?

Conclusion

Are these epicenter stocks worth further research? When looking at the epicenter trend, it is very simple. The stocks to keep an eye on are broad, as well as the sectors they are in. In many cases, they can be open to interpretation. As the world continues to reopen, it might be a good idea to have a list of reopening stocks on your list. All things considered, which epicenter stocks made it onto your watchlist?